Welcome to the world of FamZoo Prepaid Card, a unique solution designed to prepare children for real-world financial situations. This innovative tool combines prepaid cards with a comprehensive family finance app, providing an engaging way for kids, teens, and parents to learn about money management. FamZoo’s mission goes beyond just handling cash; it’s about financial education, equipping families with skills to navigate the financial landscape strategically and securely.

By integrating chores, budgets, and savings goals, FamZoo transforms everyday tasks into meaningful financial lessons. This blog post explores the numerous features and benefits of FamZoo, highlighting how it serves as a reliable educational platform for families.

Empowering kids through financial literacy

The FamZoo Prepaid Card is not just another financial product; it’s a bridge to financial literacy. With a focus on teaching children the fundamental principles of managing money, FamZoo stands out as a pioneer in youth financial education. Parents can use this tool to introduce their kids to budgeting, saving, and smart spending habits. From setting up subaccounts to control spending to automating allowances, FamZoo provides parents the tools they need to instill sound money habits in their children.

This goes beyond theoretical knowledge, offering practical, hands-on financial management practice in a safe, controlled environment. Understanding financial responsibility at a young age can have a profound impact on a child’s future. FamZoo’s innovative features, such as compound interest on savings and chore tracking, encourage kids to engage with money meaningfully, fostering a financially savvy future generation.

Developing smart spending habits

The FamZoo Prepaid Card helps children develop prudent spending habits by allowing them to manage their own finances. This not only boosts their confidence but also prepares them for handling more complex financial tasks as they grow older. Parents can guide their children in setting goals and tracking their spending through FamZoo’s comprehensive app.

Whether they’re buying something online or spending at local stores, kids can learn how to make informed purchasing decisions. With real-time card activity alerts and the ability to lock and unlock cards, parents have the reassurance of oversight without hovering over every transaction. This balance helps children learn from their experiences, making FamZoo an excellent tool for cultivating accountable spending behaviors.

Promoting savings and generosity

In addition to spending control, FamZoo emphasizes savings and charitable giving. With features such as parent-paid interest and savings goal tracking, children are motivated to save money, effectively teaching them the value of delayed gratification. The app also encourages acts of generosity by providing options for charitable donations, which can be incorporated into their financial goals.

This not only imparts a sense of social responsibility but also aligns with many families’ values. By creating incentives for saving and sharing, FamZoo supports children in developing balanced financial perspectives. Understanding both the importance of saving and the joy of giving equips kids with a well-rounded financial education.

Tailored financial tools for families

FamZoo’s versatile features stand out in their ability to cater to various family dynamics. Its customization options ensure that each family can set up their financial learning environment to suit their unique needs. For instance, sub-accounts allow every dollar to have a designated purpose, promoting orderly financial management. Families can adjust allowance and chore systems to motivate positive behaviors and track progress.

With flexible configurations such as chore penalties or rewards, FamZoo provides parents with the power to tailor financial lessons and reinforce their family’s values. Furthermore, parents can track loans and automate billing within the family, ensuring that each aspect of financial education mirrors real-life scenario handling. By adapting these features, FamZoo continues to offer unparalleled flexibility and control for family financial education.

Security and accessibility

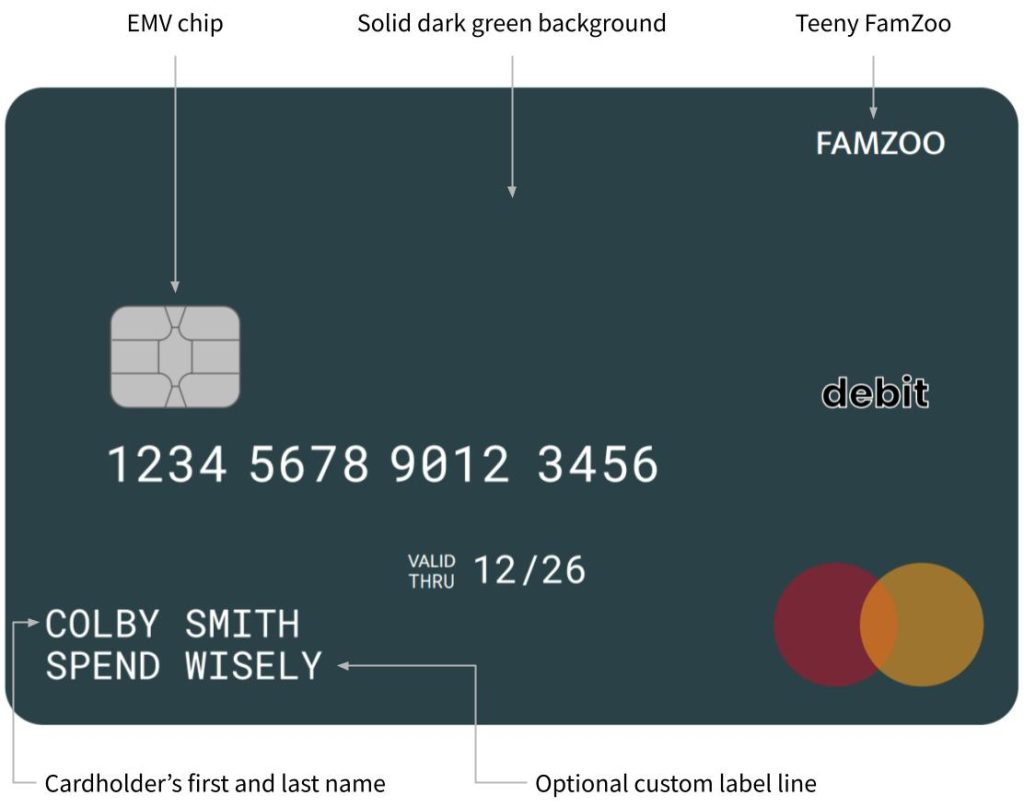

Security is a top priority for FamZoo. The prepaid card system is designed to be secure by offering features like instant card-to-card transfers and FDIC insurance. This ensures that families can engage in financial learning without fear of loss due to unforeseen incidents. Accessibility further enhances FamZoo’s offering. With apps available on both iOS and Android platforms and access through any web browser, families can manage their finances conveniently from any device.

Additionally, FamZoo provides direct deposit options for teens and detailed transaction reporting, supporting a seamless and transparent financial education experience. These measures ensure that while children engage in practical money management, they do so within a secure framework.

Customer support and satisfaction

FamZoo prides itself on exceptional customer service. The platform not only provides expert financial advice and resources through its blog and FAQs but also maintains a high standard of customer satisfaction, with easy access to support whenever needed. The company’s commitment to education and customer service has earned it numerous accolades and positive customer reviews.

Testimonials from satisfied users highlight the app’s effectiveness in teaching responsible financial habits while providing a seamless user experience. By prioritizing education and quality service, FamZoo has established itself as a trusted partner for families looking to raise financially savvy children. Whether just beginning their financial journeys or looking to advance their skills, families will find valuable support and resources with FamZoo.